Saya tertarik melihat kembali Laporan Keuangan (LK) Berkshire Hathaway Inc. (BRK) tahun buku 2020, sebuah perusahaan investasi besar di US dengan CEO & Chairman Warren Buffet (WB), yang kekayaan nya diatas USD 100 billion (sebagian besar dalam bentuk valuasi saham BRK). Laporan keuangan 2020 BRK bisa diperoleh dari link berikut: https://berkshirehathaway.com/2020ar/202010-k.pdf.

Dalam tulisan ini, hanya akan melihat 2 bagian summary dalam LK BRK + 1 hal unik yang selalu ada di cover Letter WB. Untuk Letter WB atas kinerja BRK tahun 2020 bisa diperoleh disini: https://berkshirehathaway.com/letters/2020ltr.pdf.

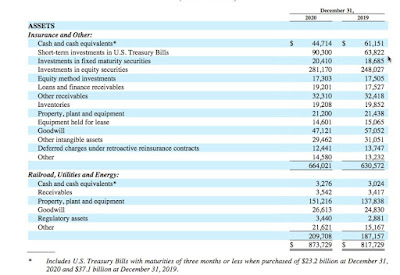

1. Posisi Aset (Assets)

Dari summary asset di akhir 2020, nilai saham yang dipegang BRK (marketable securities/perusahaan terbuka atau tbk) sebesar USD 281 bn, yang dihitung sesuai harga market 31 Desember 2020. Dengan total asset BRK sebesar USD 873 bn, maka sekitar 32% komposisi asset dalam bentuk equity securities dan cash & equivalents termasuk T-bills sektar USD 150 bn atau 17% dari total asset.

Diluar equity securities dan cash & equivalents tersebut, artinya lumayan besar porsi direct investment (porsi sekitar 49% asset) di perusahaan yang dibukukan baik dengan metode pembukuan equity-method (BRK termasuk controlling group, meskipun anak perusahaan tersebut tbk) maupun dengan metode consolidated (aset & liabilitas anak usaha dimasukan ke dalam buku LK Berkshire) dimana BRK sebagai controlling group (pemegang saham yang bisa mengendalikan perusahaan) dan anak-anak usaha non-tbk.

Ada 2 poin yang menarik dari posisi aset tersebut:

- Kalau hanya membandingkan total asset equity securities (saham perusahaan tbk) dan cash equivalents saja maka komposisi nya menjadi 65% vs 35%. Artinya komposisi tersebut masuk dalam range komposisi Portfolio Saham dan Kas yang disarankan Benjamin Graham antara 25-75% (Ref: The Intelligent Investors). Graham sendiri adalah panutan dan mentor WB.

- BRK sebagai perusahaan holding investasi, ternyata porsi asset securities & cash nya 'hanya' 51%, dan 49% nya adalah dari operating companies sebagai anak usaha nya. Jadi, terdapat manajemen resiko yang historically proven di BRK terutama saat menghadapi kemungkinan market crash di pasar saham.

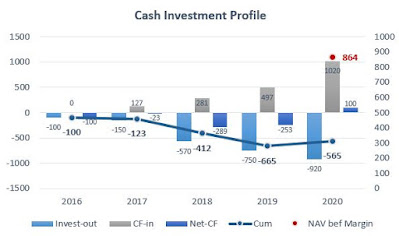

2. Pendapatan (Revenues)

Yang juga menarik adalah komposisi pendapatan BRK 2020, dimana mayoritas berasal dari anak usaha operasional (operating companies) USD 237 bn. Lalu, pendapatan dari dividen saham sebesar USD 8 bn atau dividend yield (tingkat dividen, nilai dividen dibagi harga saham) sekitar 3% dari nilai saham nya (USD 281 bn). Sedangkan estimasi capital gain dari nilai investasi USD 40 bn.

Terdapat 2 poin juga yang bisa diambil dari profil pendapatan BRK 2020 tersebut:

3. Return tahunan nilai saham

Ini hal yang menarik untuk melihat kinerja saham BRK dibandingkan dengan kinerja saham dalam S&P 500 (500 saham yang dimasukan dalam kelompok oleh Standard & Poors). Histori dimulai di 1965 hingga 2020, menghasilkan total kenaikan saham BRK sebesar 2.8 juta % (iya, diatas 2 juta persen!), dibandingkan S&P 500 sebesar 23.4 ribu %.

![[ blog of mine ]](http://3.bp.blogspot.com/-hUUqkUUXufQ/UVt7DcdguGI/AAAAAAAABa0/ha3UfCENYuc/s830/trianshadow.jpg)